If needed, you can round the numbers for net income and total assets to make the calculation easier. Divide net income by total assetsįinally, find the quotient of the company's net income and total assets by dividing the company's net income by its total assets, with the net income being the numerator and the total assets being the denominator (Net Income / Total Assets). This information can be found on the company's balance sheet. Using the average total assets for your calculation may result in a more accurate calculation because a company's total assets can vary over time. The next step is finding the company's total number of assets or average total assets. This information can be found at the bottom of a company's income statement. Net income is the amount of total revenue that remains after accounting for expenses. The first step in calculating a company's return on assets using this method is to find the company's net income.

Return on assets how to#

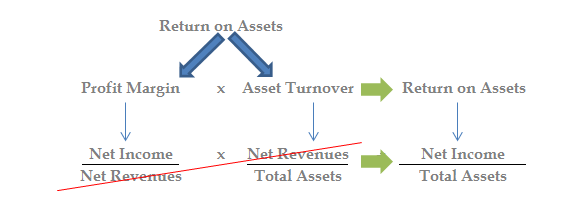

Related: Your Guide to Careers in Finance How to calculate return on assets using net income and total assetsįollow these steps to calculate a company's return on assets using the company's net income and total assets: Related: Your Guide to Careers in Finance How to calculate ROA The second method is to multiply the company's net profit margin by its asset turnover rate. The first method is to divide the company's net income by its total average assets. There are two separate methods you can use to calculate return on assets. Related: How to Choose a Career Return on assets calculation methods Generally, the higher a company's return on assets percentage is, the more efficient the company's management is in generating profit from its assets. This will allow you to compare how well a company is performing compared to other companies. However, it is important to make sure you are comparing numbers for companies that are similar in size and are in a similar industry. You can also use the company's return on assets percentage to compare the company to similar companies. Doing this can help investors determine whether a company is likely to have potential issues in the future.

You can begin by comparing a company's return on assets percentage from one year to another and looking for trends or changes. Knowing how to calculate a company's return on assets is important because it is a valuable measurement that both investors and business owners can use to determine how efficient the company is at using its assets to generate a profit. Related: The Value of Increasing Your Business Vocabulary Importance of return on assets For example, if a company's ROA is 7.5%, this means the company earns seven and a half cents per dollar in assets. Return on assets is represented as a percentage. This information is valuable to a company's owners and management team and investors because it is an indication of how well the company uses its resources and assets to generate a profit. Return on assets (ROA) is a ratio that tells you how much profit a company earns from its resources and assets. In this article, we discuss everything you need to know about return on assets including how to calculate return on assets with examples. Knowing how to calculate a company's return on assets can help investors determine whether to invest in a company and can help business owners measure how well their company is performing from one year to another in comparison to other companies in their industry. There are several measurements businesses and investors use to determine how well a company is performing, and one of the most stringent measurements in return on assets.

0 kommentar(er)

0 kommentar(er)